Stora Enso Oyj Financial Statement Release 2019

Record high cash flow despite a challenging quarter

Q4/2019 (year-on-year)

Year 2019 (year-on-year)

Outlook for 2020

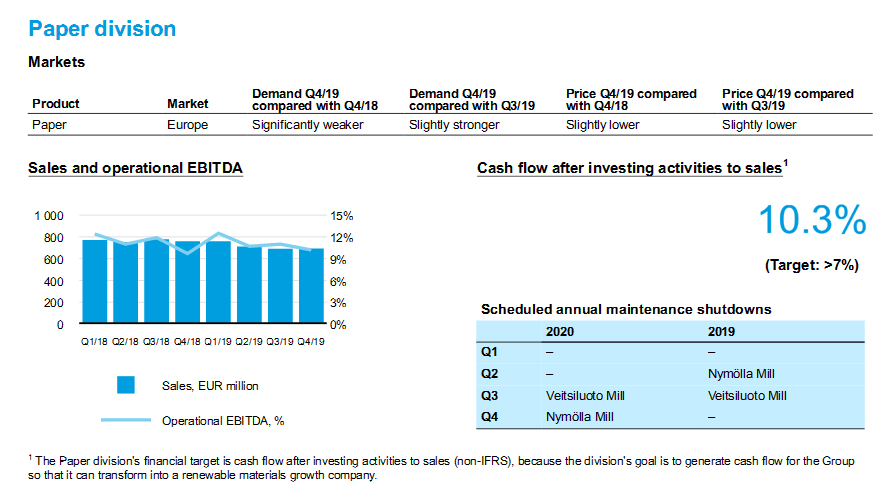

Subdued and mixed trading conditions caused by geopolitical uncertainties are expected to continue to impact Stora Enso in 2020. The decline in demand for European paper will persist, and demand for other Group products is expected to remain mixed. Exceptionally mild winter conditions in the Nordics with reduced period of frozen soil could impact harvesting and transport of wood and may therefore affect the stability of raw material supply and potentially increase wood costs to our Nordic mills.

Stora Enso will continue active cost management in 2020–2021 through the profit protection programme implementation. The fixed and variable cost savings target is EUR 275 million to the end of 2021. Various labour unions in Finland are currently on strike which is expected to impact result negatively.

Guidance for Q1/2020

Q1/2020 operational EBIT is expected to be in the range of EUR 90–200 million. During the first quarter, there will be an annual maintenance shutdown at the Ostrołęka Mill paper machine 5. The total maintenance impact is estimated to be approximately EUR 60 million and EUR 10 million lower than in Q4/2019 and in Q1/2019 respectively.

Various labour unions in Finland are currently on strike which also affects Stora Enso’s operations. The negative impact of these three-week labour actions is included in the above guidance range for Q1/2020.

Stora Enso’s President and CEO Annica Bresky comments on the fourth quarter 2019 results:

'Year 2019 was concluded by a challenging quarter characterised by demanding market conditions, especially significantly lower pulp prices. We have focused on what we can impact: our costs, cash flow and managing value over volume. We are satisfied that we were early out with our profit protection programme. It is proceeding ahead of plan and the total implemented cost saving amounted to EUR 150 million in 2019. We will now continue to work on the areas that we can control, to be prepared for a more profitable future when the cycle turns.

Our forest fair valuations have increased significantly since the publication of our third quarter results. The impact came mainly from the forest fair valuation increases in our forests in Sweden and Tornator in Finland.

The lower prices during the quarter had a negative impact on sales and operational EBIT. However, the impact on operational EBIT was partly offset by lower costs achieved through the profit protection programme. I am pleased that we had a record cash flow from operations, due to good working capital management, and extra dividend and capital repayment from Bergvik Skog. Looking at the whole year of 2019, sales remained above EUR 10 billion. Our operational EBIT decreased and was unsatisfactory.

The Board of Directors proposes to the Annual General Meeting a dividend of 0.50 euros per share, unchanged from last year.

Our transformation projects are progressing well, and the kraftliner production at the Oulu Mill is expected to start by the end of 2020. We are also strengthening our portfolio through innovation. To deliver viable alternatives to fossil-based plastics, we have invested to build a pilot facility for bio-based plastics. With this step, we target applications such as barriers in transparent packaging. Together with the Finnish start up Sulapac, we have additionally commercialised a renewable and biodegradable straw. This is one of our contributions to combat the global problem of plastic waste.

We continue to launch new products that enable our customers to leverage digital solutions to further advance their businesses. In this area, I am proud that we have entered into a global partnership with Atos to bring new automated retail solutions and services to the market. With radio-frequency identification (RFID) technology, we enable e-kiosks designed for on-the-go purchasing.

As sustainability is at the core of our business, we take further steps to promote wooden buildings. We have launched a new building concept that makes it easier for architects, engineers and developers to design office buildings from wood. We are engaged in a number of new wooden building projects, this quarter in Austria, Belgium, France, the Netherlands and Switzerland. Building in wood can bring up to 70% faster construction time, up to 80% fewer truck deliveries on site as well as cut carbon emissions by up to 75%, just to mention some of the benefits.

As the development towards a circular bioeconomy is accelerating in society, we are creating an organisation that further strengthens our ability to drive innovation and sustainability with a common agenda. Therefore, we created a new structure for our packaging divisions at year end. As of 2020 our new Forest division, which will better enhance value creation from our forest assets, will be reported separately to increase transparency.

When it comes to the business climate in the Nordics, I would like to raise a word of caution. For the forestry industry, like for any other industry, we need predictability. Therefore, it is problematic when society is impacted by strikes, which has been the case around the new year. It is utterly important for our countries in this region of the world, to secure the competitive position of exporting industries and ensure that we are well equipped to compete globally.

I can now look back on my first two months in the role as CEO, and I am proud and excited to work with our talented colleagues across the company. We are here to deliver growth and profits, and push the boundaries of sustainability forward together with existing and new customers, partners and investors.

The future grows in the forest!'

|

|

Stora Enso Full year financial results (.pdf)

January–December 2019

Stora Enso Annual Report 2019 (.pdf)

Источник: STORA ENSO OYJ